Why I Left Retirement to Build Again—and What I’m Building Now

Why Robert Ritch left retirement to build again

Why Robert Ritch left retirement to build again

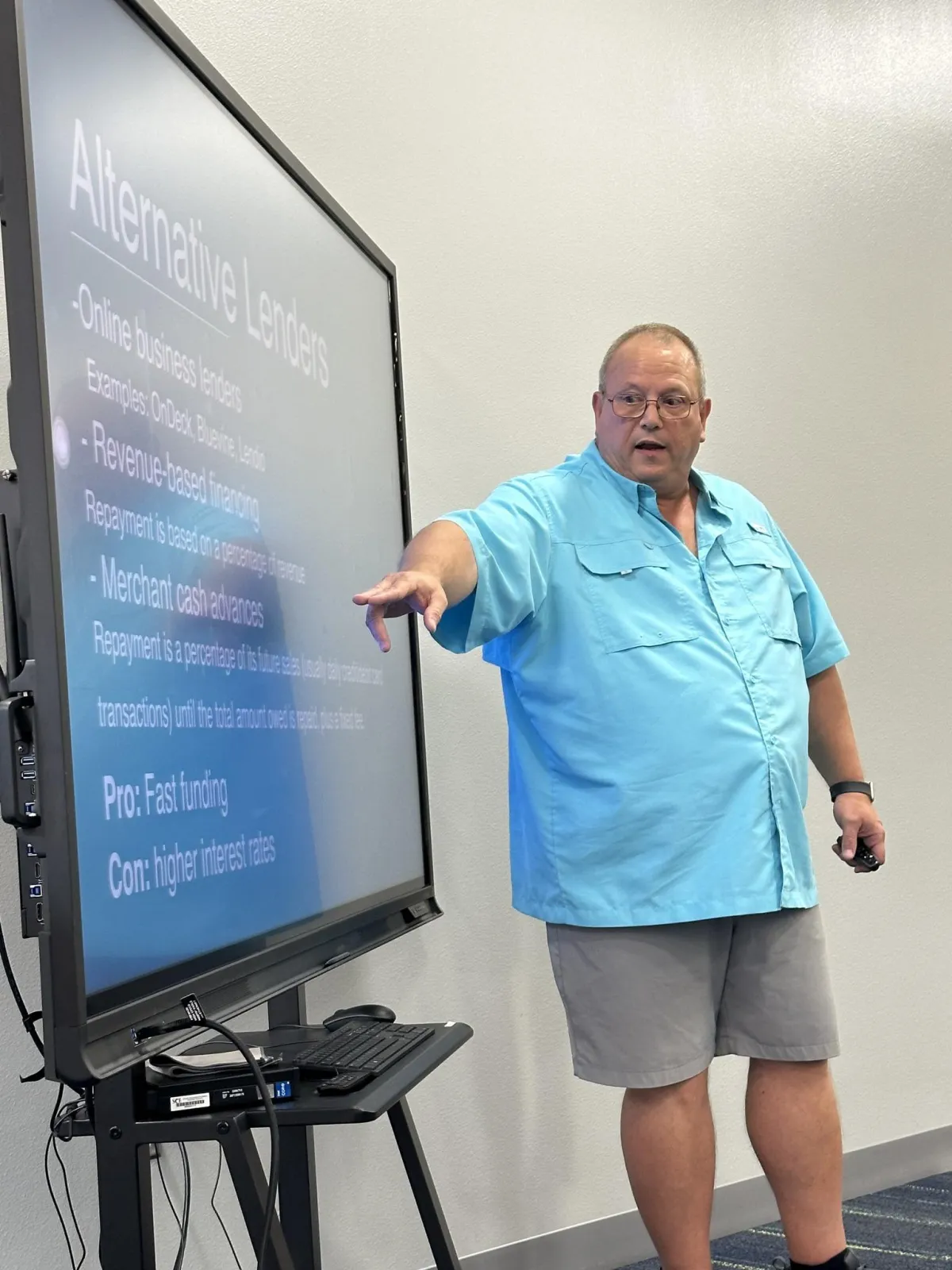

Robert Ritch shares funding strategies with veteran entrepreneurs at 26 West Center, covering debt, equity, crowdfunding, and how to build a smart capital stack.

Robert Ritch shares capital strategies from Hustle Bar, covering debt, equity, crowdfunding, leasing, and how to mix funding methods for growth.

Robert Ritch is a Florida-based entrepreneur, investor, and turnaround strategist with more than three decades of experience building, restructuring, and advising private companies. He originally founded Ritch Ventures in Tennessee, and today leads the firm from Florida—partnering with founders, investors, banks, and advisory firms to support corporate turnarounds, distressed asset strategies, and innovative capital raises.

Robert relocated to Florida in 2021 to launch a new chapter of his career focused on helping small and medium-sized businesses in transition—whether they’re navigating operational challenges, preparing for investment, or seeking a second chance. He brings deep insight into small business finance, media, and deal structuring, and has advised dozens of companies across industries.

Robert’s work is rooted in practical experience and real-world results. Through Ritch Ventures and affiliated companies, he helps clients unlock growth, rebuild credibility, and attract new investment—even under difficult circumstances.

Beyond business, Robert is committed to community impact. He and his wife Misty co-founded Big Dreams Through Small Steps, a nonprofit initiative focused on helping children and families thrive. From drowning prevention programs to youth development, the organization reflects their shared belief in practical support and long-term opportunity for those who need it most.

Based in Manatee County, Robert is actively involved in Florida’s growing entrepreneurial ecosystem and regularly contributes insights on capital strategy, private investing, and corporate renewal.